OUR INVESTMENT CASE

Accelerating growth and driving shareholder value

At Inchcape, we leverage our global automotive Distribution expertise, strong OEM partnerships, and data-driven capabilities to deliver sustainable growth and shareholder value. With a focus on operational excellence and expanding in high-growth markets, we are uniquely positioned to capitalise on the evolving mobility landscape.

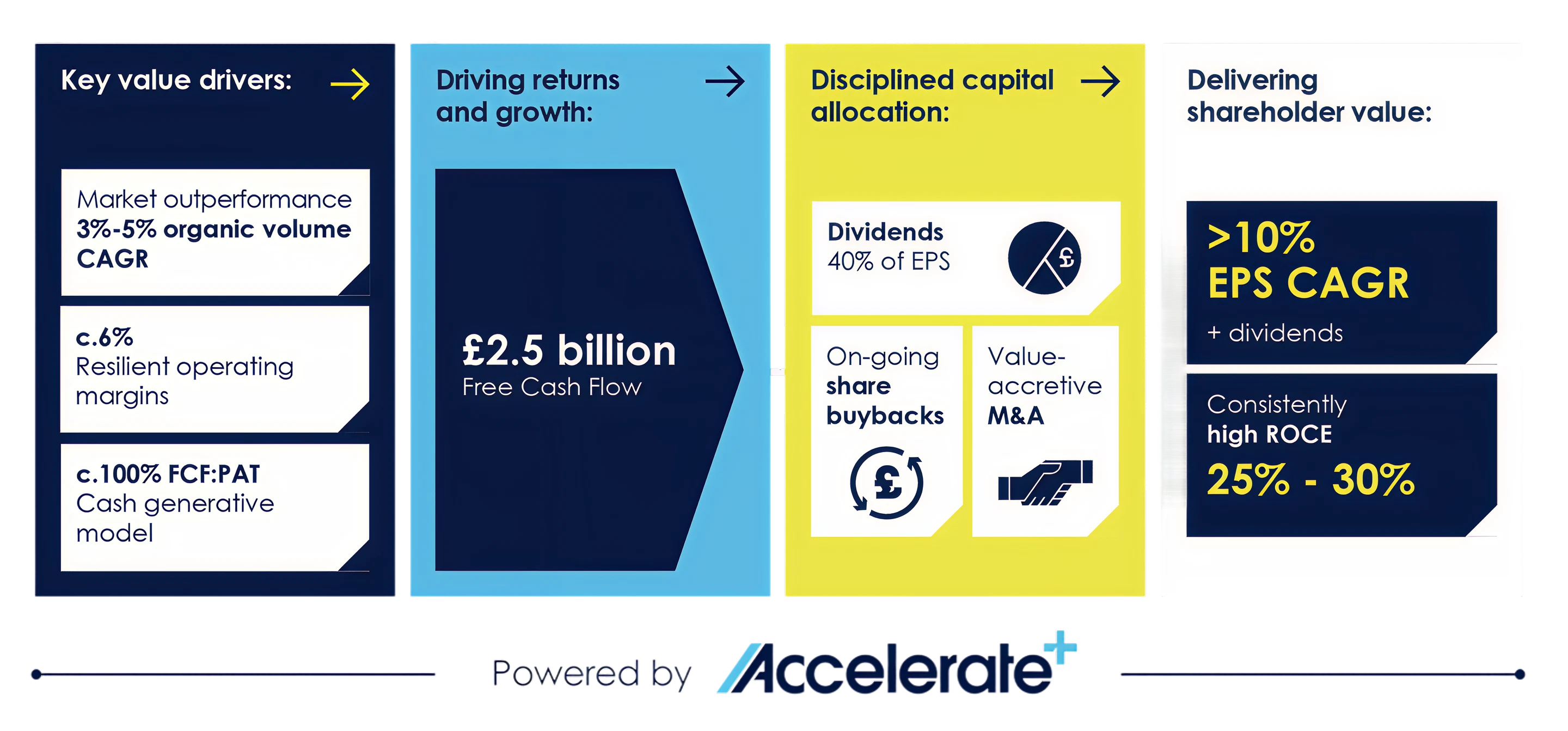

Medium term targets: 2025 – 2030, through-the-cycle

Our transformation

Since 2016, Inchcape accelerated its transformation toward a Distribution-focused business. We have:

-

Tripled our OEM partnerships and more than doubled our new vehicle volumes as part of our strategic transformation to a global automotive Distributor.

-

Pursued strategic, value-accretive M&A including the acquisition of Derco, the largestautomotive distributor in Latin America, in 2022 and several bolt-on acquisitions, in the context of an industry which remains highly fragmented.

-

Continued to optimise our operations, disposing of a range of non-core retail assets.

Our Accelerate+ strategy will continue to enhance our position as the world’s leading independent automotive Distributor.

Three pillars of our investment case

The leading global automotive Distributor

- Long-term, diversified OEM portfolio

- Deep competitive moat through technology

- Scaled and diversified geographic footprint

With an attractive financial profile

- Growth driven by market outperformance

- Resilient operating margins

- Highly cash generative and capital efficient

Driving shareholder value

- Clear dividend policy

- Commitment to on-going share buybacks

- Value-accretive acquisitions

PILLAR 1

Leading global automotive distributor

Our opportunity for growth

A substantial Total Addressable Market with significant growth opportunities for Inchcape.

Our Total Addressable Market (TAM) are markets typically characterised by high GDP growth, low motorisation rates, more complex and is estimated to be around 10.8 million vehicles sold annually. We have a market share of only 3% of this TAM, emphasising our opportunity for growth. The chart below brings this to life, showing that if we were to reach our 10% market share ambition over the long term, we would treble the size of our business.

Achieving this ambition, with a scaled and diversified OEM portfolio across our markets, will drive:

- Sustainable performance over time, for Inchcape, our OEMs and shareholders;

- Scale in a market, which brings benefits in areas like procurement efficiencies;

- Top line growth, as we work with an expanding range of brands in a given market;

- Increased operating leverage and stronger margins, by driving more brands through our operating cost base;

- New revenue opportunities, as OEMs look to launch new product offerings, by leveraging our share in a market.

Explore our regions

PILLAR 2

Attractive financial profile

Growth driven by outperformance

Our diverse global presence helps us navigate market volatility. While overall market growth is expected at 1–2% annually, we aim to outperform by growing market share through our existing contracts and new wins, driving 2–3% volume growth. Together this means targeting 3–5% organic compound growth before acquisitions.

2 -3 %

Market outperformance

Resilient operating margins

Around 85% of our revenue comes from vehicles and 15% from parts. We generate gross margins of 15–18%, with higher margins on parts (40–45%) than vehicles (10–15%). Our variable cost base supports resilient operating margins, with a typical automotive distributor in the range of 5-7%, and with our business at a historic blended margin of c.6%.

6 %

operating margins

Highly cash generative

Our capital-light model consistently delivers strong free cash flow, with a track record of converting over 100% of profit after tax. Optimising working capital, especially in newly acquired businesses, has been a key driver. We expect to generate £2.5 billion in free cash flow through to the end of 2030.

100 %FCF

PAT conversion

Capital efficient and high ROCE

ROCE reflects the Group’s continued focus on high-margin, capital-light Distribution. The divestment of non-core retail assets and the integration of value-accretive acquisitions has supported efficient use of capital. As we scale our Distribution platform through technology, contract wins, and strategic M&A, we expect ROCE to remain consistently high between 25-30%.

25 -30 %

ROCE

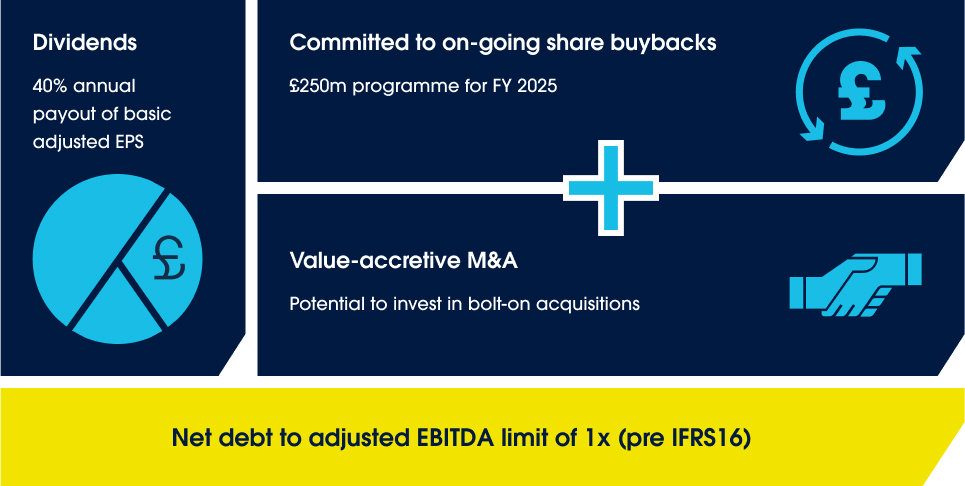

Our capital allocation policy

We have set ambitious targets to grow our business responsibly, seeking to create significant value for all of our stakeholders. Our disciplined approach to capital allocation is detailed below.

Investor contact

Discover more

Results, Reports & Presentations

Discover moreDiscover our latest results, reports, and presentations in one place, helping investors stay informed and aligned with our long-term strategy.

Discover more

Sustainability for investors

Learn moreExplore how our Sustainability practices are embedded into our strategy, operations, and long-term growth plans, driving sustainable value for investors.

Learn more