Earlier this year, we published medium term targets that set out the financial direction of Inchcape to the end of 2030, providing our investors with a clear, definitive roadmap on our growth and value creation journey.

As we continue to make progress against these targets and deliver our Accelerate+ strategy, I want to dig a little deeper into how a combination of consistent growth and disciplined capital allocation position us to deliver, not just in the second half of the year, but over the medium term.

Our growth algorithm

As the leading global automotive distributor, we operate in about 15% of the worldwide automotive market (approximately 11 million cars annually), and within these markets, we currently hold a 3% share. So, the opportunity for us to increase our share, adding value to consumers and our OEM partners through our differentiated distribution platform, is enormously exciting for our colleagues and shareholders.

We expect our markets to grow 1-2% annually over the medium term, and while some markets can experience volatility, overall, we anticipate an upward trend in the coming years.

Our approach to growing Inchcape’s share of this expanding market is clear: strengthening our existing OEM partnerships to deliver volume growth in existing markets, winning new distribution contracts – we have secured 53 new distribution contracts since the start of 2022 – entering new vehicle categories, and executing on strategic acquisitions that drive value.

Our recent bolt-on acquisition of Askja in Iceland, completed earlier this month, marks our entry into a new market, strengthens our presence in Europe and establishes new OEM relationships; it is a great example of the scale component of our Accelerate+ strategy in action.

Alongside our scale ambitions, we will continue to optimise our Distribution platform to further enhance our position as a brilliant partner for our OEMs, and deliver an exceptional experience for end customers, through value-added services.

Value creation

While the automotive market is changing all the time, the resilience of our business model and its ability to create value for shareholders is perhaps best illustrated through a cash lens.

The highly cash-generative nature of our business means we anticipate generating £2.5bn of free cash flow through to the end of 2030. When deployed in line with our disciplined approach to capital allocation, this will create value for shareholders and drive our enterprise value.

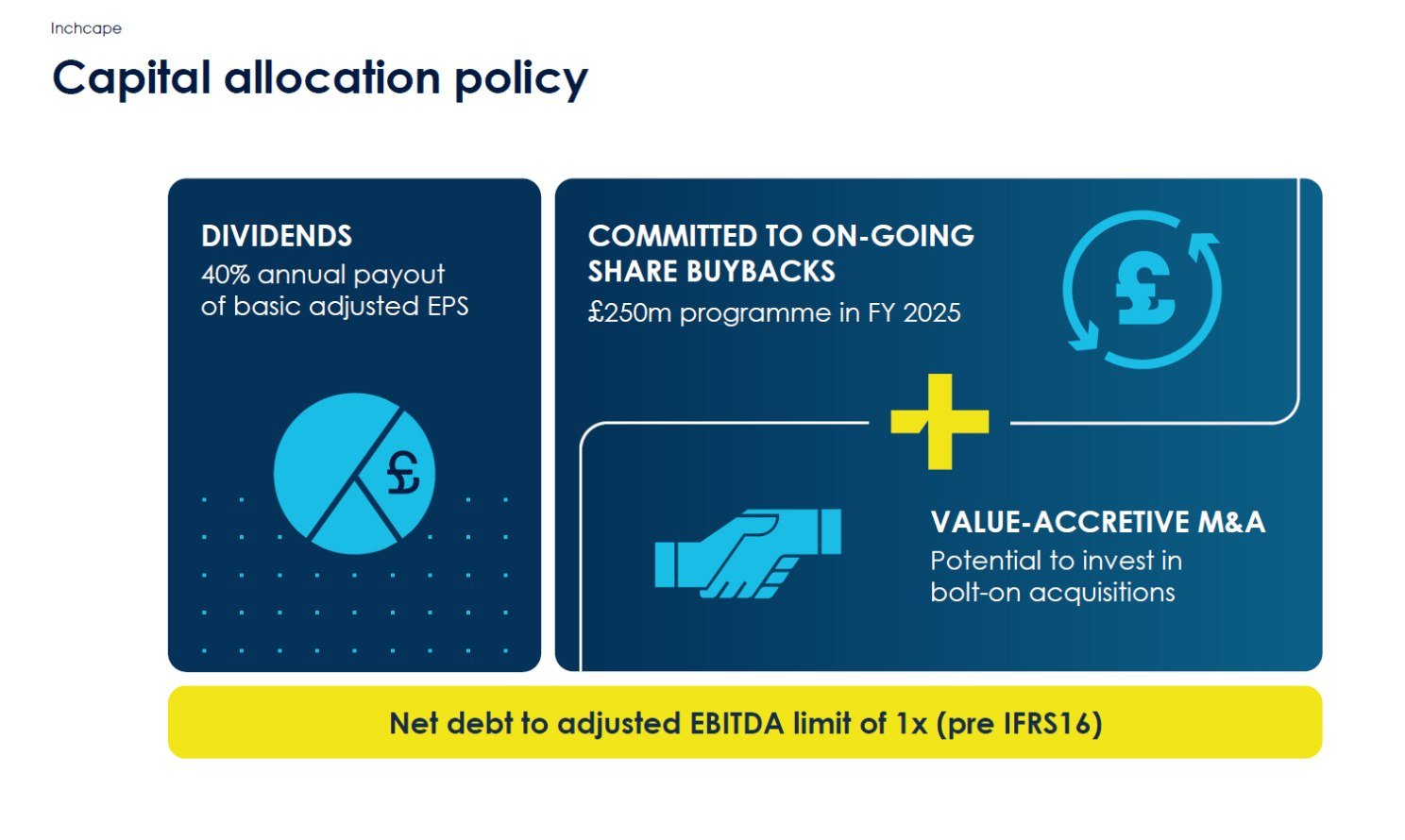

Our first capital allocation priority is to reward our shareholders with a dividend. After that, we balance capital allocation between our commitment to ongoing share buybacks and value-enhancing acquisitions.

Earlier this year, we announced a £250m share buyback programme, and we have already acquired approximately £170m in shares as part of this programme. So, in total, we have returned approximately £240m to shareholders this year through dividends and share buybacks.

On acquisitions, we will continue to target bolt-on acquisitions to drive further scale and diversification across our business.

Moving forward with confidence

Across Inchcape’s markets, we are making great strides strategically, operationally and financially. By continuing to grow our share through scaling and optimising our business, and allocating capital in a disciplined way, we have a clear roadmap to deliver compound annual EPS growth of over 10%, through to 2030, while maintaining our high levels of return on capital employed.

As ever, it is our people whose hard work and talent enable us to fulfil our financial objectives, and I’d like to thank them all for their continued dedication.

Adrian Lewis

Chief Financial Officer